To the pride of buyers around the cryptosphere, the cost of bitcoin (BTC) has rallied over 53% since its low of US$15,476 (£12,519) in November. Now buying and selling round US$23,000, there’s a lot communicate that the ground has after all been reached for the main cryptocurrency after a yr of painful decline – in November 2021, the cost peaked at nearly US$70,000.

If this is the case, it’s now not best excellent information for bitcoin yet the entire marketplace in cryptocurrencies, for the reason that others extensively transfer in step with the chief. So is crypto again in industry?

Dotcom classes

The previous is plagued by more than a few sessions of marketplace turmoil, from the worldwide monetary disaster of 2007-09 to the COVID-19 cave in in 2020. However neither of those is a in particular excellent comparability for our functions as a result of they each noticed sharp drops and recoveries, versus the sluggish unwinding of bitcoin. A greater comparability will be the dotcom bubble burst in 2000-02, which you’ll see within the chart underneath (the Nasdaq is the index that tracks all tech shares).

Nasdaq 100 index 1995-2005

Buying and selling View

Have a look at the bitcoin chart because it peaked in November 2021 and the cost motion appears to be like slightly an identical:

Bitcoin undergo marketplace value chart 2021-23

Buying and selling View

Each charts display that undergo markets undergo more than a few sessions the place costs upward push yet don’t achieve the similar degree as the former top – referred to as “decrease highs”. If bitcoin is following a an identical trajectory to the early 2000s Nasdaq, it will make sense that the present value will probably be any other decrease prime and that it is going to be adopted via any other decrease low.

That is in part as a result of just like the 2000s Nasdaq, bitcoin appears to be following a development referred to as an Elliott Wave. Named after the famend American inventory marketplace analyst Ralph Nelson Elliott, this necessarily argues that right through a undergo section, buyers shift between other emotional states of sadness and hope, sooner than they after all melancholy and come to a decision the marketplace won’t ever flip of their favour. It is a ultimate wave of heavy promoting referred to as capitulation.

You’ll see this concept at the chart underneath, the place bitcoin is the golf green and pink line and Z is the prospective capitulation level at round US$13,000 (click on at the chart to make it larger). The black line is the trail that the Nasdaq took within the early 2000s. The blue pointing finger above that line is doubtlessly the similar position to the place the bitcoin value is now.

Bitcoin now vs Nasdaq within the early 2000s

Writer equipped

The only thing more to notice at the chart is the wavy line that’s transferring horizontally alongside the ground. That is the stochRSI or stochastic relative energy index, which is a sign of when the asset appears to be like overbought (when the road is peaking) or oversold (when it’s bottoming).

An indication of a coming shift is when the stochRSI strikes in the other way to the place the cost is heading: so now the stochRSI is coming down yet the cost has held up round US$23,000. This too suggests a fall may well be coming near near.

The sport of wealth switch

Inside of markets, there may be regularly a sport that buyers from establishments corresponding to banks and hedge budget play with beginner (retail) buyers. The purpose is to switch retail buyers’ wealth to those establishments.

That is in particular simple in an unregulated marketplace like bitcoin, as a result of it’s more straightforward for establishments to govern costs. They are able to additionally communicate up (or communicate down) costs to fan the flames of retail buyers’ feelings, and get them to shop for on the best and promote on the backside. This “traps” the irrational buyers who purchase at upper costs, moving wealth via giving the establishments a possibility to transform their holdings into money.

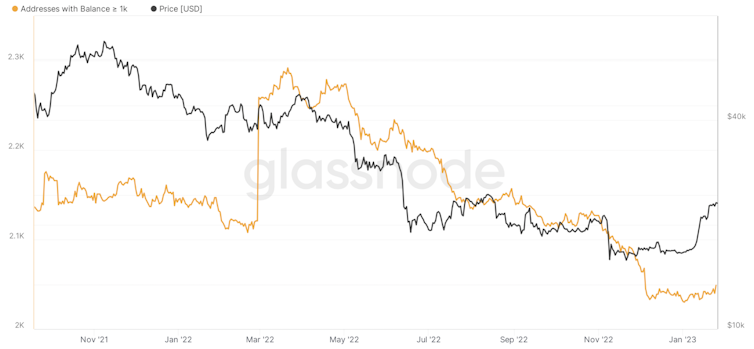

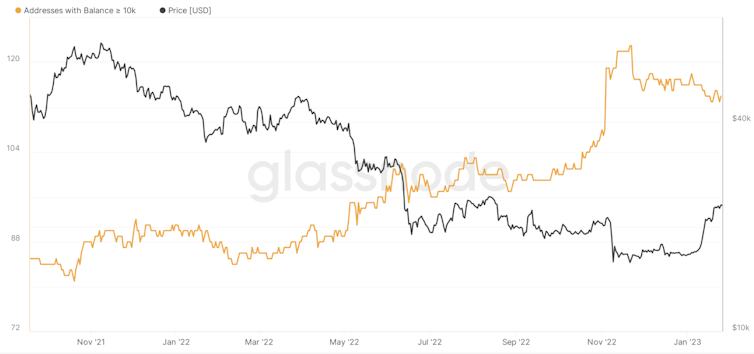

It subsequently is sensible to check how the retail and institutional buyers had been behaving in recent times. The next charts evaluate the ones crypto pockets addresses that hang 1 BTC or extra (most commonly retail buyers) with the ones conserving upwards of one,000 BTC (institutional buyers). In all 3 charts, the black line is the bitcoin value and the orange line is the choice of wallets in that class.

Retail investor behaviour

Glassnode

Institutional investor behaviour pt 1

Glassnode

Institutional investor behaviour pt 2

Glassnode

This presentations that for the reason that FTX scandal again in November, which ended in the arena’s second-largest crypto alternate cave in, retail buyers had been purchasing bitcoin aggressively, ensuing within the perfect choice of addresses conserving no less than one BTC ever. However, the largest institutional buyers had been offloading. This means that the institutional buyers accept as true with our research.

The place we’re heading

There are those that argue that bitcoin is a bubble and that in the end cryptocurrencies are nugatory. That’s a separate debate for any other day. If we suppose there’s a long term for blockchains, which can be the web ledgers that permit cryptocurrencies, the important thing query is when bitcoin will achieve the buildup section that generally ends a undergo section in any marketplace.

Referred to as Wyckoff accumulation, this is the place the cost of the asset many times exams two spaces: the higher sure the place investors in the past bought closely sufficient for the cost to forestall emerging (referred to as resistance), and the decrease sure the place investors purchased closely sufficient that the cost stopped happening (referred to as toughen).

On the level the place institutional buyers come to a decision the decrease sure has proved to be sufficiently resilient – in different phrases, they believe the cost is affordable at that degree – they’re going to get started purchasing the asset once more. That second is best prone to come after there was a capitulation.

After all, historical past does now not repeat itself precisely. It can be that is the primary time that retail buyers have outsmarted the huge establishments, and that the one manner is now up.

Much more likely, then again, there may be extra ache at the manner. With a recession at the playing cards, exceptional process layoffs and vulnerable retail information popping out of america, it doesn’t level to the type of optimism that has a tendency to transport markets upper. It could subsequently make sense to brace your self for any other plunge in the cost of bitcoin and the remainder of the crypto marketplace.

Supply Via https://theconversation.com/bitcoin-has-shot-up-50-since-the-new-year-but-heres-why-new-lows-are-probably-still-ahead-198682